Global UV Disinfection Equipment Market Research

Persistence Market Research Released New Market Report on “Global Market Study on UV Disinfection Equipment: Waste Water Segment to Witness Highest Growth by 2019,” the global UV disinfection equipment market was valued at USD 993.4 million in 2012 and is expected to grow at a CAGR of 14.1% from 2013 to 2019, to reach an estimated value of USD 2.5 billion in 2019.

The UV disinfection market is expanding due to the replacement of customary chlorine-based disinfection to the advanced disinfection techniques resulting from rising consumer, global and corporate awareness about the health hazards from chemical based disinfection.

Several benefits associated with UV disinfection equipment include its low installation and operation cost, residue-less functioning and ease of maintenance. UV treatment takes only 6-10 seconds in the contact tank whereas chlorine takes around 15-20 minutes of treatment time. The growth of allied industries such as healthcare and chemicals are increasing the scope of UV disinfection equipment. Government initiatives for providing safe drinking water is a further growth indication for this market.

Based on their wavelengths (intensities), there are three types of Ultraviolet rays: Ultraviolet A (UVA), Ultraviolet B (UVB) and Ultraviolet C (UVC) with long (400-315 nm (nanometers)), medium (315-280 nm) and short (280-100 nm) wavelengths, respectively. UVA finds its application in PC Case-blue light, counterfeit money detection, air conditioning, air purification, scanning and disinfecting dishwasher. UVB is used in zoology and botany studies and UVC is used in disinfection of air, water and surface. Across all wavelengths, UV disinfection equipment uses UVC lamps for disinfecting the targeted objects.

The trend of combined use of ozone and UV disinfection has been increasing in order to create multiple barriers for Cryptosporidium (a disease causing gastrointestinal illness and diarrhea) and Giardia (the protozoan parasites causing Giardiasis). The Long Term 2 (LT2) Surface Water Treatment Rule of the EPA (Environmental Protection Agency) demonstrates that public water systems in the U.S. that use surface water or ground water are required to reduce the Cryptosporidium levels in source water by 2-logs (99%). Cryptosporidium microorganisms are chlorine-resistant and can be filtered and disinfected through microfiltration, ozonation, and UV disinfection. This lays further opportunities for the advanced disinfection techniques including the UV.

The Western European countries, including the U.K., France and Spain, are expected to invest around $123.8 billion by 2017 in the treatment of drinking water and water network facilities which is expected to increase the UV disinfection market of the region significantly. This investment will include refurbishments as well as building of new water and waste water treatment plants (WWTPs). Both are expected to raise scope for the UV disinfection equipment market as the expired disinfection equipment are expected to be replaced by the newer technologies including ozonation and UV, of which UV is expected to have a larger share due to its lower overall cost.

The UV Light Emitting Diode (LED) was introduced into the UV disinfection equipment market in 2012 which is growing swiftly due to characteristics such as energy efficiency and compact size. A UV LED based disinfection system costs around USD 279 per annum where the average annual energy consumption of a traditional UV lamp is around USD 4,562 per annum.

North America dominated the global sales of UV disinfection equipment market in 2012, followed by Asia Pacific and Europe. North America is expected to retain its leadership position through 2019 due to the increasing market for advanced water treatment technologies and the growth of the healthcare industry in the U.S.

Featured articles and news

Building Safety recap January, 2026

What we missed at the end of last year, and at the start of this...

National Apprenticeship Week 2026, 9-15 Feb

Shining a light on the positive impacts for businesses, their apprentices and the wider economy alike.

Applications and benefits of acoustic flooring

From commercial to retail.

From solid to sprung and ribbed to raised.

Strengthening industry collaboration in Hong Kong

Hong Kong Institute of Construction and The Chartered Institute of Building sign Memorandum of Understanding.

A detailed description fron the experts at Cornish Lime.

IHBC planning for growth with corporate plan development

Grow with the Institute by volunteering and CP25 consultation.

Connecting ambition and action for designers and specifiers.

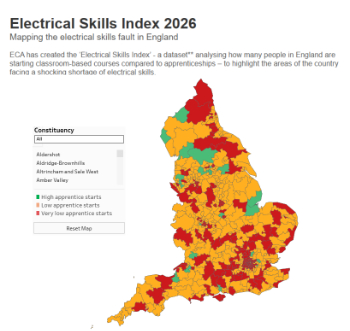

Electrical skills gap deepens as apprenticeship starts fall despite surging demand says ECA.

Built environment bodies deepen joint action on EDI

B.E.Inclusive initiative agree next phase of joint equity, diversity and inclusion (EDI) action plan.

Recognising culture as key to sustainable economic growth

Creative UK Provocation paper: Culture as Growth Infrastructure.

Futurebuild and UK Construction Week London Unite

Creating the UK’s Built Environment Super Event and over 25 other key partnerships.

Welsh and Scottish 2026 elections

Manifestos for the built environment for upcoming same May day elections.

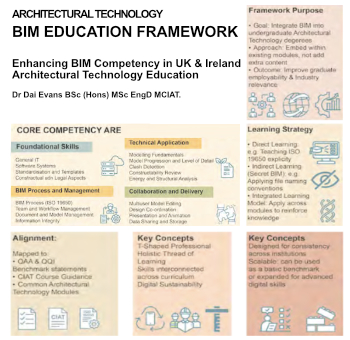

Advancing BIM education with a competency framework

“We don’t need people who can just draw in 3D. We need people who can think in data.”

Guidance notes to prepare for April ERA changes

From the Electrical Contractors' Association Employee Relations team.

Significant changes to be seen from the new ERA in 2026 and 2027, starting on 6 April 2026.

First aid in the modern workplace with St John Ambulance.

Solar panels, pitched roofs and risk of fire spread

60% increase in solar panel fires prompts tests and installation warnings.

Modernising heat networks with Heat interface unit

Why HIUs hold the key to efficiency upgrades.